Restoration Hardware's Accounting Anomalies Remain Unanswered

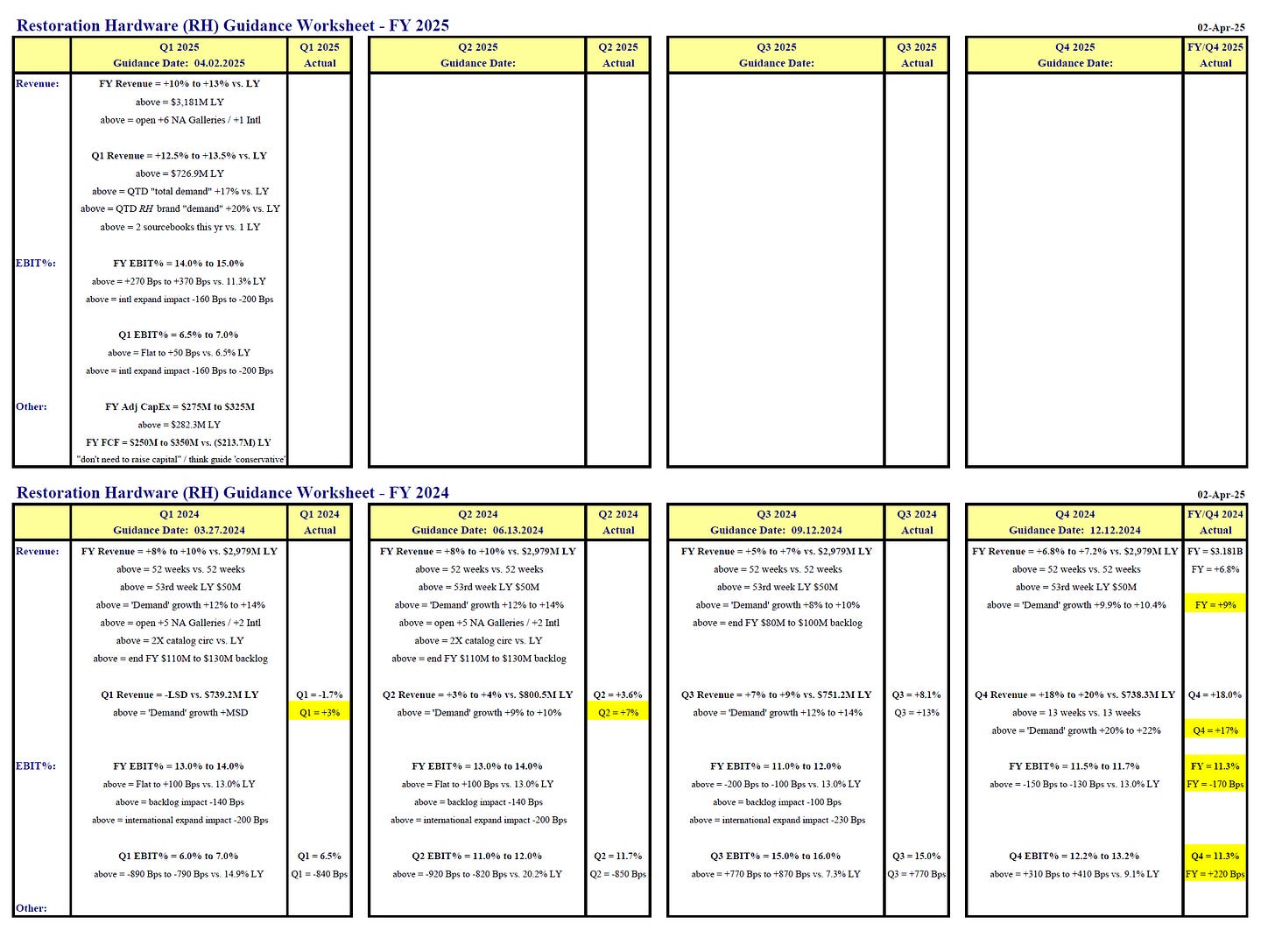

Expecting a top-line and bottom-line 'beat' in Q1 2025. But, as catalog circulation flattens versus LY there's plenty of downside EPS risk in 2H 2025 and FY 2026.

Thursday afternoon, Restoration Hardware (RH - $178.98) announces the company’s Q1 2025 financial results.

In Q1 2025, I suspect that the company will report a better-than-expected top-line and bottom-line. The large-scale catalog circulation increase versus LY will be the primary driver.

But, I believe there’s plenty of downside EPS risk in 2H 2025 (relative to consensus sell-side expectations) as catalog circulation versus LY is likely to flatten. Also, the company’s bloated levels of inventory (14 consecutive quarters of inventory growth > revenue growth) and the ill-advised aggressive international expansion will continue to depress profitability.

I’m not entirely convinced that RH makes > $10.00/share next year (consensus = $14.17), let alone this year. I think by the end of this calendar year that will become more apparent.

There are more than a few accounting anomalies that RH management has been unwilling to answer. Over the past 9+ months, I’ve sent questions to the CEO and the company’s IR representative with a request to meet and discuss further. But, my questions and meeting requests have been ignored.

A few of these anomalies can be seen in my recent earnings preview note (see below). For example…

Why has Deferred Revenue growth been relatively flat versus the prior year when ‘demand’ growth has been so strong of late?

Why did Advertising Expense only increase +14% in FY 2024 versus the prior year when management suggested that its catalog circulation in FY 2024 doubled versus the prior year?

Why has the core brand’s membership declined -42% between the end of FY 2021 and the end of FY 2024?

I doubt answers to these and other accounting anomalies are forthcoming.

That said, one thing is guaranteed… the quarterly conference call this afternoon will be a doozy! Get your popcorn ready!

Last quarter, listeners to the conference call got to hear the CEO go full MAGA and extol the virtues of our president’s foreign trade policies (i.e., tariffs). Of course, since then there have been more than a handful of iterations of the policy that was unveiled in early-April 2025.

In essence, the CEO is a live-wire! The CEO has been the company’s worst enemy from an IR perspective (e.g., prematurely inflating investor expectations). But, if anything, his quarterly conference calls have a high level of entertainment value.

Happy RH earnings day to those who celebrate!

Here’s what I wrote to clients this week.

If you would like me to send my full company Data Packet, just send me an email (Rob@TiburonResearchGroup.com) via your work email address and I’d be happy to send you a PDF version.