Plenty of Near-Term EPS Upside Remains at AMZN

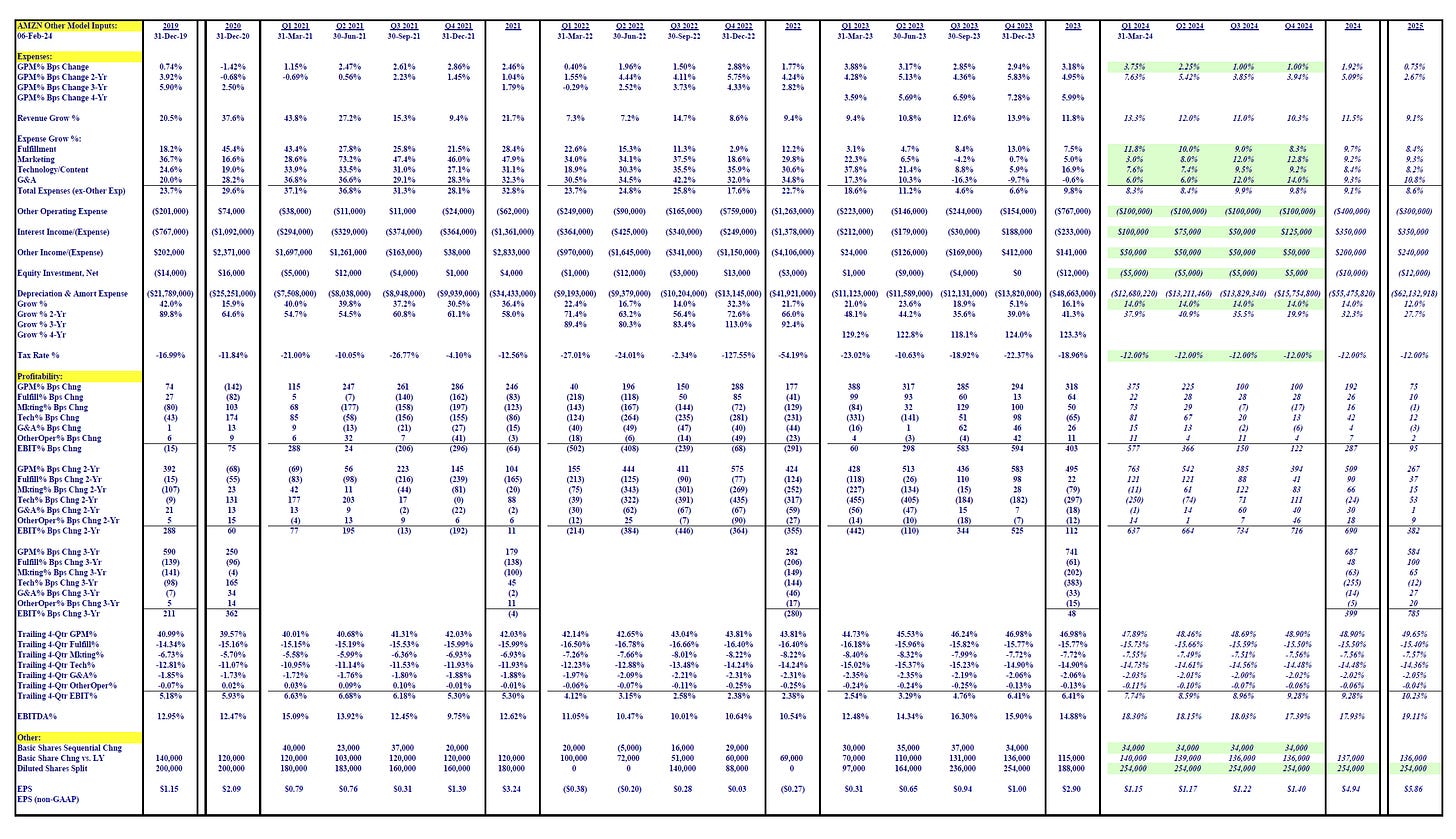

Large-Scale logistics investments in FY 2021 and FY 2022 are driving the company's outsized EBIT% improvements of late.

This week, consumer earnings season is kicking into high gear! After the bell, Amazon (AMZN) is set to report its Q1 2024 earnings.

The profitability success story of late has been a function of leveraging the large-scale logistics investments in FY 2021 and FY 2022.

Below, you’ll see some brief thoughts I published for clients ahead of the earnings release along with a review of my underlying estimates. Needless to say, I see no red flags over the next few quarters at AMZN. But, buy-side expectations are high.

It’s going to be a fun afternoon! I’ll be primarily focused on Starbucks (SBUX), one of my favorite structural short ideas, where similar to AAPL, expectations are incredibly low headed into the print.

Note: As always, if you have any questions or comments please don’t hesitate to reach out to me at Rob@TiburonResearchGroup.com.