Lululemon's Baffling Inventory Shrink Provision

The company's inventory shrink provision in their 10-K oddly implies that organized retail crime is not a problem for the company.

Over the past couple of years, we’ve all heard about organized retail crime. Initially, our lawmakers, police, and retailers were asleep at the switch. But, each of these institutions are beginning to make progress in addressing the problem.

When I worked in the industry some 25 years ago, we used to believe that the majority of our inventory shrink walked out of the back door versus the front door. Given the prevalence of organized retail crime, that premise may or may not be the case today.

Which brings me to an odd disclosure in Lululemon Athletica’s (LULU) recent10-K filing.

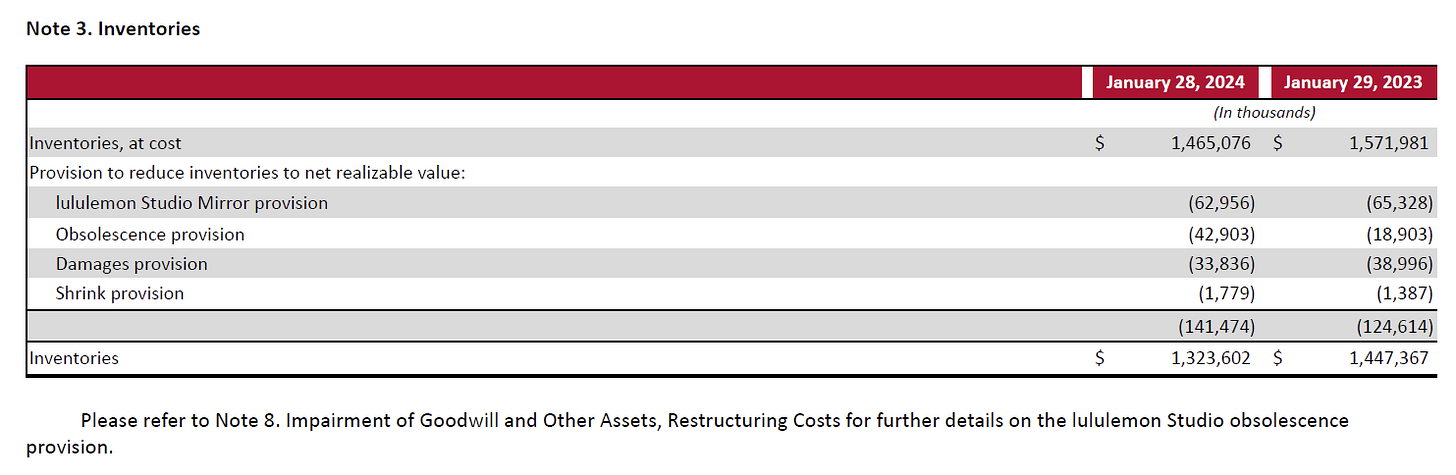

In the FY 2023 10-K filing, LULU provides an inordinate amount of detail re: its inventory reserves. I believe that this is the most granular level of disclosed inventory reserve detail I’ve seen in my career of covering consumer companies.

Here it is…

Note that the company only began to provide this level of inventory reserve detail in last year’s 10-K filing.

Think of the $1.465B “Inventories, at cost” number as ‘gross’ inventory. For some reason, they’re still showing us the Mirror provision ($62.956M). Odd, but let’s ignore that for now.

What’s fascinating (at least to me) is they’re disclosing an obsolescence provision ($42.903M), a damages provision ($33.836M), and a shrink provision (a paltry $1.779M).

The combination of these 3 sub-reserves appears reasonable to me. Again, taking the Mirror provision out of the equation, the other three reserves total roughly 5.5% of ‘gross’ inventory.

But, I would have thought the ‘shrink’ provision would be a much, much larger part of the 5.5%… especially in the era of organized retail crime. Instead, the company appears to believe that its inventory shrink is essentially a rounding error.

I live in the Bay Area and follow on Twitter/X my favorite crime reporter Henry Lee (you can see him in that fascinating documentary on Netflix called “American Nightmare”).

He keeps me abreast of what’s happening re: organized retail crime here in the Bay Area.

Many, many times I’ve seen him tweet something similar to the following…

In other words, it’s obvious that Lululemon is a prime target of those involved in organized retail theft. It makes complete sense.

Which takes me back to LULU’s shrink provision. Why so low? Or, why so OBVIOUSLY low?

In the company’s defense, it’s possible that the damages and obsolescence provisions are inflated and that maybe I should be combining all 3 provisions when thinking about what the ‘true’ shrink provision should be.

But, if I take the company at their word, it does not take a Big 4 auditing firm to recognize that the inventory shrink provision is too low.