I Have an Analyst Crush on... Dollarama!

Dollar stores in the U.S. are struggling. It's the exact opposite with one discount chain in the Great White North.

I’ll admit, I have an “analyst crush” on Dollarama (DOL-CA), the Canadian value retailer with over 1,500 locations with fixed price points up to $5.00.

DOL-CA may have the most pristine business model in retail today. Let’s take a look…

The company struggled with its profitability (EBIT%) heading into the pandemic, but has more than weathered higher levels of distribution/logistics costs with higher price points of late. The company’s EBIT% is now at an all-time high.

Conversely, here in the U.S., dollar stores are struggling.

Family Dollar (DLTR) loses money if you allocate corporate expenses to the chain (the chart below is prior to a reasonable allocation of corporate costs).

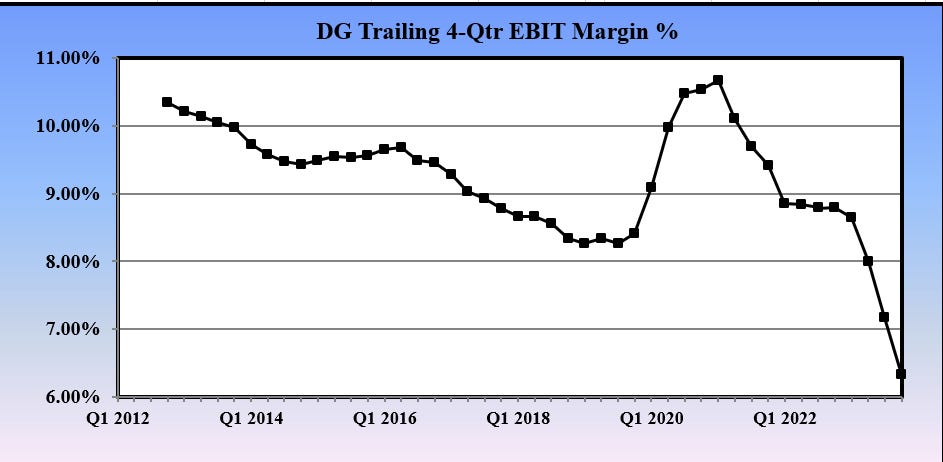

Dollar General (DG) has had a rough time of late.

And, now privately-held 99 Cents Only is liquidating.

Of course, the dollar store struggles here in the U.S. are not keeping Dollar General from continuing to open new stores (a completely foolish strategic decision)…

So, are the dollar store operators in Canada simply superior to their peers here in the U.S.? Gosh, maybe.

But, it also may have something to do with an over-stored (dollar stores) environment here in the U.S.

It’s a bit of a shocker to think that Dollar General expanded its store base by +23% between the end of FY 2019 and the end of FY 2023. But, they did! Family Dollar grew its store base +7% over the time frame (Dollar Tree grew +12%).

Why Canadian dollar stores (at least Dollarama) materially outperform their U.S. dollar store peers from a bottom-line perspective is above my pay-grade. I’d be happy to pass along any theories that you may have re: the topic.

But, getting back to my “analyst crush.” It’s possible that Dollarama has the best business model in retail today (FY 2023 EBIT% = 24.2%… excluding DollarCity equity share).

DollarCity (532 stores in El Salvador, Guatemala, Colombia, and Peru) appears to be a home run, but that’s another blog entry for another day.

I’ve only been in a Dollarama store once (downtown Vancouver while waiting to get on a Disney cruise) and it almost made me want to (gulp!) move to Canada!

This management team sticks to their knitting.

But, I especially enjoy listening to the company’s conference calls. Management is honest and does not make the specious claims that we hear all too often when other management try to put lipstick on their pig.

Also, many times retail management teams convince themselves that they need BIGGER stores. Many a retailer has “jumped the shark” and began to open larger stores (in the case of Family Dollar… much larger stores). Therefore, it’s always refreshing to listen to a management team that truly understands their biz model and is not swayed by a few quarters of out-sized comp stores sales growth.

Here’s a quote from the Q2 2023 conference call in September 2023 when responding to the National Bank analyst asking about whether the company sees an opportunity to increase its store footprint…

“Our store size feels like a good size to us, that 10,000 square feet box. There's always going to be exceptions where we have truly strong stores in smaller locations. And, as always, our real estate team works on trying to grow the size of those stores. But, corporately, I don't think we have felt any change in our philosophy or outlook on what the right box looks like as a whole, and I think it's that simple.”

Here’s another quote that I highlighted from the Q1 2023 conference call in June 2023…

“Our approach from day one has always been the day-in, day-out lowest price in the market. We don’t react to promotional activity. We never have. So, when somebody is promoting, often their price is better than ours, not usually by a lot but by some. And, we don’t go chasing that price. We’re not changing our price. If they’re going to beat us on something that they’ve decided to have as a loss leader or to take terrible margins on, that’s their business decision. We’re in the everyday low price business. So, if you come into our stores at back-to-school, you’re probably going to pay more for the 100-pack of loose leaf white paper than you will walking into another retailer that’s giving it away at that time of year. But, for the other 11.5 months of the year, we’re cheaper.”

Sticks to their knitting, not swayed by investors or sell-side analysts, pristine numbers, no non-GAAP/IFRS adjustments, tells it like it is sans embellishment.

That’s what I consider an “analyst crush.”